In this guide, we will walk you through the process of swapping or exchanging your...

What's the Difference Between Car Finance and Car Subscription?

This guide compares PCP (Personal Contract Purchase) and Car Subscription, so you can make an informed choice when choosing how to get behind the wheel of your next car.

PCP has been around a lot longer than Car Subscription and has been rapidly adopted in the last 20 years. Subscription by comparison is relatively new in automotive, although is not an entirely new concept and has already transformed other industries because of its benefits.

Before we get going, I’ll explain all the sections of this guide so you can easily skip to sections you want to read. They’re below:

- What is PCP?

- What is Car Subscription?

- What's Value for Money?

- What's Best For You?

What is PCP or car finance?

PCP or Personal Contract Purchase was introduced in 1992 as a way to get a car without buying it outright, so instead of paying £50,000, you’ll pay a much smaller upfront fee to get that car, that’s why we’ve seen it become the most popular way to get a car in the last few years.

Car Buyer had this to say about the recent boom in the car finance and PCP market:

''In 2010 under 60% of new cars sold at dealerships were bought on finance, in 2020 it’s closer to 90%. This dramatic change has been driven by the PCP deal, which accounted for 75% of the UK’s consumer car finance market in 2019.'

This is how a PCP works:

- Upfront payment

- Monthly fee

- End payment

A PCP comes with two lump sum payments, one at the beginning and one of the end, formally known as a balloon payment, which you only pay for if you want to own the car after the financing period has ended. You can also use any ‘equity’ you have and transfer it for your next upfront payment on a different car. We’ll talk more about equity in terms of PCP later on.

What is a Car subscription?

Wagonex was formed in 2016, and was the first car subscription company in the UK. Since then, Car Subscription has become an established way to access cars because it’s the only option if you want flexibility with monthly subscriptions that can easily be swapped for another vehicle.

Car Subscription is a completely online service, which is different to many other forms of accessing cars.

We had to make this possible because our customers want to change their car from wherever they are, and with subscriptions as short as a month to as long as 24 months, our subscribers are driving new cars all the time. You can do all this from your Profile section of www.wagonex.com.

You can simplify a subscription into two steps.

- Refundable deposit

- All inclusive monthly fee

Subscription makes it easy for you to pick your car based on your current situation, but most drivers today with traditional forms of finance expect to be in the same car for as long as 5 years.

We feel that’s a burden that drivers shouldn’t have to deal with, almost every driver is either bored of driving the same car, or needs a new car to fit their rapidly changing lifestyle before you’re even close to the end of a lease, PCP or Hire Purchase.

To make that process even easier, subscription typically only asks you to pay a refundable deposit that is based on the car you’re ordering. A clear example is a Renault Zoe which will have a smaller refundable deposit of around £200 while a Polestar 2 might have a £750 deposit, but it is very rarely more than the price of a month's subscription.

If you return your car in good condition at the end of your subscription, your money is quickly returned to your account.

Online or offline?

PCP is available online or off. You can compare prices of each PCP deal quite easily because retailers can now calculate the price using your initial deposit, length of contract and mileage to give you the total price per month and over the length of your contract.

Wagonex Car Subscriptions are 100% online. You search, and compare the cars on our marketplace, order the one you want and decide to have it delivered for a small fee, or pick it up free of charge. You can also calculate the price just like you would with a PCP.

When you subscribe to a car the process of purchasing the car is much easier. Instead of spending the day at the dealership signing off your terms and conditions, and organising delivery, you’ll have everything set up before you can even drive to your local dealership.

Even after your car has arrived, Car Subscriptions include your repair, MOTs and servicing, road tax and roadside assistance costs into one simple monthly payment.

If you were to use PCP, these costs are transferred to you, even though you don’t own the car, adding even more complexity to a frustrating payments process that includes balloon payments, interest, equity and much more.

Can you get the full range of cars?

You will find that both PCP and Car Subscription have a full range, however as it is more established method, PCP is generally available from every provider, regardless of whether it’s in the dealership or an online retailer.

How long is your commitment?

Car Subscriptions offer superior flexibility with 1-24 month subscriptions, PCP on the other hand is usually for at least 2 - 6 years, with the overall cost per year increasing the shorter the contract, or you could be more cost-efficient and go for a longer contract which is cheaper.

If you want to return your car two years into a three-year contract, you will have to pay the rest off before you can. The car depreciates the most during the first two years.

What is better value for money?

In this section, we’ll go a bit deeper into the finances of a PCP deal.

PCP is a way to finance the purchase of the car, the supplier will become your lender and will make it more affordable for you by agreeing to a payment plan to spread the cost.

The first thing you’ll need to work out is how much of a deposit you can make. As you can imagine, the lower your deposit the more you’ll be paying in monthly fees, so it's a decision that will need some thought.

If you have saved for a car, or have cash available, it’s the better option to lower your running costs but it’s up to you.

In most cases the supplier will offer you a contribution toward the deposit called ‘dealer contribution’ but this is only available if you agree to a different financial product, which could stipulate a higher interest rate on your monthly payments, for example. Make sure you read the small print.

Then you’ll move on to the length of contract and your mileage, both will contribute to your monthly payments, more mileage equals a higher monthly fee and lowering the length of your contract will do the same.

Last, but not least is the APR. If you are able to find a low APR, you will have to pay less interest, and this equates to lower monthly payments, this is based on your provider and Bank of England interest rates.

The way this works from the dealer side is they take into account the brand new value of the car, and the expected Gross Market Final Value (GMFV) .

The assessment on the expected GMFV will be carried out by the Finance House underwriter, and doesn’t change based on the provider.

You will be paying the difference between the GMFV, and the brand new car value, and that’s part of the reason they can charge such low monthly payments.

An example of this without taking into account interest rates.

- A new car costs: £20,000

- The GMFV is: £12,000

- You cover the difference: £8,000

- Minus your deposit: £1,000

- You pay £7,000 spread out over monthly payments

Unlike a lease, where you can save money by paying more upfront, you will always pay the same amount overall regardless of the deposit amount.

What happens at the end of your PCP?

There are three options:

- Pay the balloon payment and own the car

- Return the car, and pay nothing, but lose your deposit.

- If the car’s value is higher than the GMFV, you can use this ‘equity’ to pay off a deposit on a new car.

Although PCP is known as a financial product that makes ‘buying’ a car more manageable, you don’t ever own the car until the final balloon payment is made. You’ll be the registered keeper, but the underwriting company holds its property rights. Unless you want to own the car, there isn’t much point paying this off.

If you can’t afford the balloon payment, you can agree to a further three years of a finance plan to pay it off but it will be a Hire Purchase with higher interest, and thus higher monthly payments.

The third option is all about the GMFV, if it’s lower than estimated GMFV, you’ll be in negative equity. That means if something were to happen, and you needed to sell the car, you wouldn’t be able to, or part-exchange it without paying the difference in value.

Another problem is that if your car was written off, you would also have to pay off the difference in value, and that’s why GAP insurance is advised, it will protect you if the car’s value is negative compared to the estimate from the Financial House but will be an extra cost.

If you flipped into positive equity, it works in reverse, you can use that equity to pay off your next deposit on a car but you won’t be able to use that money elsewhere because they will only give you equity toward another car.

The use of the term ‘equity’ has been questioned because it gives you the impression the money left over is yours, when really it’s more of a gift card to be used with the same provider.

PCP providers have been put under some heavy scrutiny for this, you can read up on that here.

What happens at the end of the subscription?

You have three options:

- End your subscription

- Renew your current subscription

- Swap your car

Everything is done in your Profile section of your account on www.wagonex.com.

If you want to cancel your subscription, the vehicle supplier will organise the collection of your vehicle.

If you want to upgrade, no need to cancel your subscription, but make sure to go to www.wagonex.com and find your new car at least 14 days prior to the end of your contract to make sure it arrives on time and before your current car is collected.

Upfront fees for car finance and subscription

In terms of upfront fees, you usually pay less on a car subscription. You only have to pay a refundable deposit and an admin fee on each subscription you take out.

When it comes to PCP, the upfront cost is pricey, and you won’t get the deposit back even after you return the car.

Balloon payments explained

Balloon payments aren’t part of car subscriptions, Wagonex does this to make it as easy as possible to swap your car, or ‘turn off’ your car subscription.

Let’s say that you don’t need a car all year round, or just want to downsize to something cheaper when you need to, car subscription improves that process by having a no strings attached approach.

PCP will always have an optional balloon payment, but that is very rarely used. Instead people switch their car, and opt to pay for their deposit on their next car.

Find out about the dangers of balloon payments here.

Monthly payments

The monthly payments on a car subscription will be higher than on a PCP, the reason for this is that you protect your lender from any potential downside when you pay a more expensive upfront fee.

Car Subscription has a small refundable deposit, so the risks involved for the supplier of the car are covered by having slightly higher monthly payments.

It’s also important to note that car subscriptions are cheaper the longer your contract, as an example, we’ll go through a real price comparison using the same car in the section below.

Real Life Price Comparison

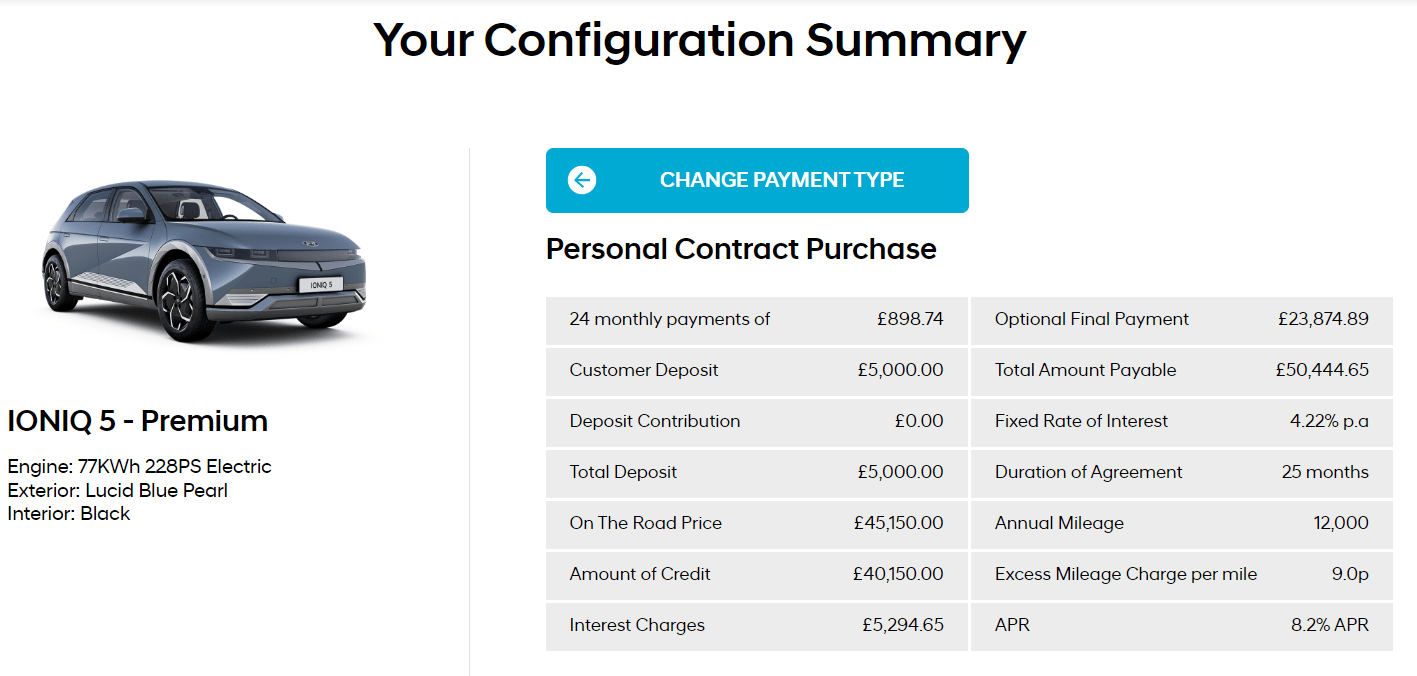

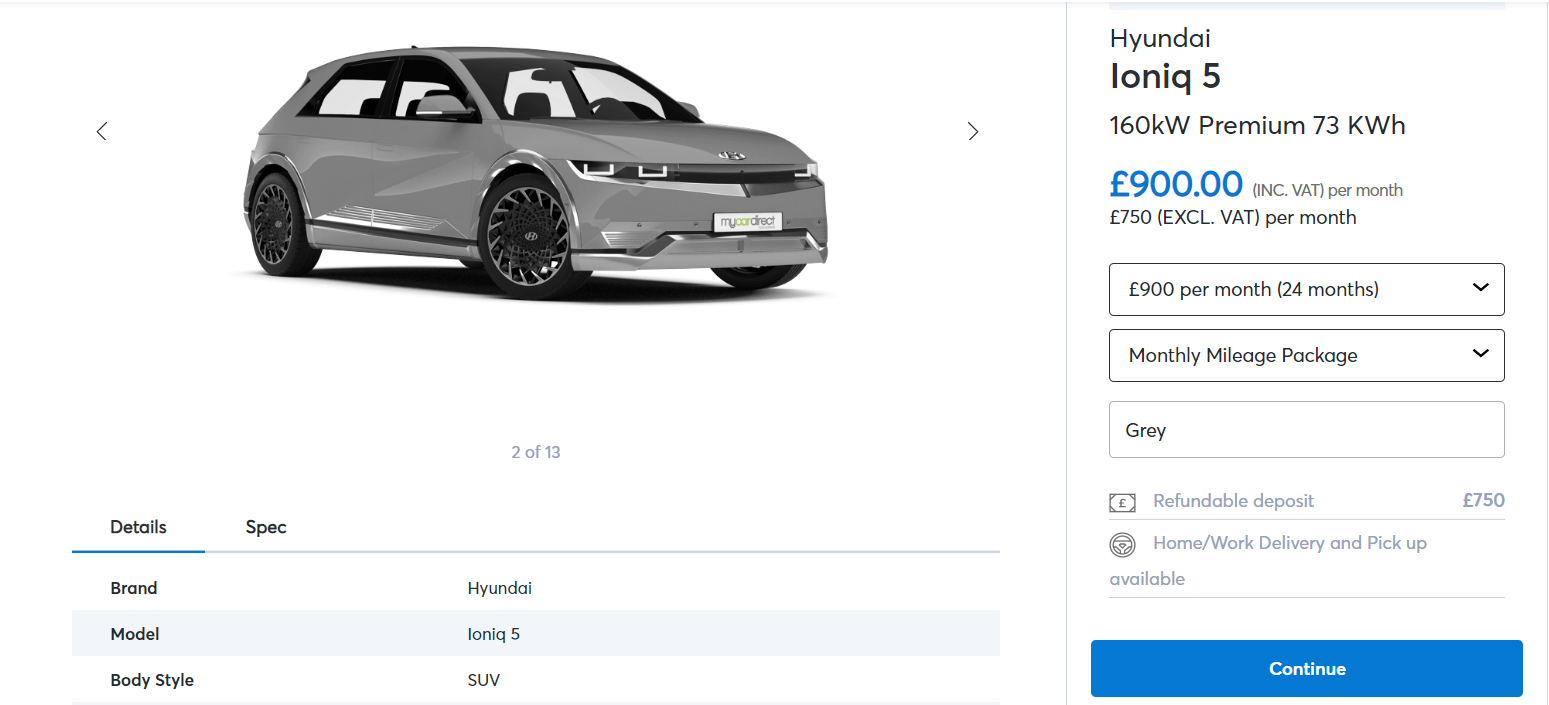

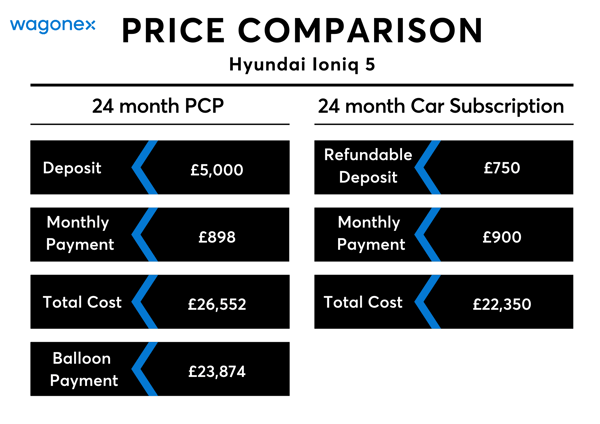

Using the Hyundai Ioniq 5 as an example, we’re using the price displayed directly from Hyundai’s website.

Here’s how it works out. With a 24 month contract and a deposit of £5,000, a comparable mileage package to what you get with a car subscription:

If you were to subscribe to the Ioniq 5 with Wagonex on the same terms, this is the price you’ll pay:

As you can see there is very little difference between the price of them both, but instead of paying a lump sum deposit of £5,000, you can get the same overall price with a refundable deposit of £750.

This is extremely attractive to people who are already saving for a house or a holiday: Why should you have to save even more money to drive the car you want?

Price breakdown*

Now we know the total cost of both deals if everything was equal but that isn’t the full picture, since a Car Subscription includes extra benefits that PCP doesn’t, we have to account for those so the next section will focus on what’s included in a car subscription that isn’t in a finance deal.

What’s Included in a PCP?

A PCP is still a way to finance a purchase, not to lease, subscribe or rent it. That means it’s your responsibility to manage and pay for:

- Maintenance and servicing

- Road Tax

- Roadside assistance

These costs are often left out of all calculations around what’s best value for money. The running costs can easily add up to hundreds of pounds a year, and increase every year you own the same car. We’ll explain them fully in the next section but the image below will illustrate exactly where your money is going.

What's Included in a Car Subscription?

Road Tax

This car is electric but it will cost £150 a year if it was a petrol car, or hybrid car.

£0

Maintenance and Servicing

After one year you will be required to service the car to be in line with the manufacturer’s warranty, usually, this is not that expensive because it’s brand new, so only need an oil, filter and possibly an air filter change.

Roadside assistance

Using Kwik Fit’s guide on running costs they state that the average driver spends £6.50 a month on breakdown cover.

£6.50

Insurance

You still need to purchase your insurance, you will just need to provide a copy of the insurance certificate to the vehicle supplier before delivery.

What is the real life value of these services?

With these figures in mind, a subscription could save you around £62 on the servicing bill and £6.50 a month, or £78 a year on breakdown cover.

In total, that’s a saving of around £218 over the 2 years, you’ll be in the car.

It might look like a small saving on paper but these costs increase the longer you’re in a PCP deal, so you can expect to pay much more in the third, and 4th year of a PCP.

Here’s another way to think about it. You won’t be worrying anymore about unexpected maintenance or servicing costs popping up, and ruining your day. It simplifies everything.

For an even deeper look into figures, read our blog on the true cost of car ownership here.

Advantages of PCP over Car Subscription

Lower Monthly Payments: The way that a PCP is set up makes it more affordable on a monthly basis, so if you have some savings to pay a big deposit, you will save considerable amounts on your monthly pay check.

Fierce Competition: PCP is widely available from almost every car manufacturer and dealership, making it more likely that they’ll be discounts in the form of dealer contributions and favourable APRs.

A Path to Ownership: Even though most people don’t buy the car outright with the final balloon payment, many drivers will still like the option if they love the car, and would prefer to pay the balloon payment instead of stepping back into the car market, where you'll pay the full price for the vehicle.

Positive Equity: In every PCP deal the GMFV value can change negatively, or positively but there is still a chance that you have some extra cash left over to spend on a nicer car.

Advantages of Car Subscription over PCP

Lower Upfront Costs: Car Subscription lowers the barrier to entry for so many people that are boxed out of the market because of costly deposits, and ultimately you don’t pay more overall than you would on a PCP with a big deposit.

Easily Change Your Car: Car Subscription is the only solution for people who want to drive a car for less than 2 years and be cost-effective at the same time.

Stress Free Alternative: Before the car even leaves the forecourt to be dropped at your doorstep, road tax, breakdown cover and maintenance and servicing already wrapped up and ready to go, you pay one simple monthly fee for everything. No hidden costs.

Transparency: Understanding all the jargon involving a PCP is just straight up confusing, APRs, interest rates, balloon payments, equity. Why bother? Just pay your monthly subscription, and drive.

More Options: If you were to use a manufacturer’s financing plan, chances are you would continue to use them because you have money invested in them that can’t be transferred to other providers.

An example of this is the chip shortage where PCP deals are being extended because they can’t get the car, but people feel forced to continue the same process. Subscription gives you more choice to shop around and go elsewhere if you no longer want to subscribe.

What’s Best For You?

Following the detailed breakdown comparing PCP with Car Subscription, it has to be said that subscription is the superior way to get your next car.

When you look at the overall prices of both, they are similar but the extra benefits outside of the price alone is the difference maker.

From the fast checkout, without piles of paperwork, to better customer service and then the simplicity of having everything included in the subscription, without any confusing terms and conditions that take days to mull over. Subscription takes away all that added stress.

However, this isn’t a decision for us, it’s on you, so if you look at your finances and the way you drive, would you prefer to be able to easily swap your car to fit your changing needs? If you do, a subscription is definitely worth a try.

If you don’t like higher monthly payments you should consider a PCP because you can save for a bigger deposit and ease some pressure on your month to month spend but remember you will always pay the same amount in the end.

If you prefer to worry less, I'm assuming you do, we can comfortably say that car subscription will make your day to day life much easier, you won’t be worrying about the end value of the car, and how much equity you have or balloon payments. Get the car, pay the monthly subscription, that’s it!

Want to read more content about car subscription? Here's some content that's similar to this:

- Leasing vs Subscription

- Car Rentals vs Car Subscription

- Buy or subscribe to your next car?

- What is car subscription?

*Prices correct at time of writing.

Time to Hit the Road and Discover the UK's Best Driving Routes

.png?width=552&height=107&name=Image%202%20(2).png)